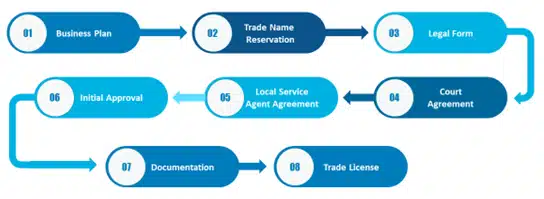

8 steps to start insurance company in UAE

Believe it or not, starting an insurance company in the UAE can be a great way to increase your income. The UAE is an incredibly competitive and global marketplace, and its citizens are some of the best-educated in the world. This makes for a perfect market for businesses looking to expand, and there are many opportunities available to entrepreneurs here.

There are a few things you need to consider before launching your business in the UAE—and these include understanding the local regulatory environment, getting started with pricing plans, and ensuring your product is credible and meet customer needs. To get started, contact one of our experienced consultants today who will help you navigate through all of these waters and give you some tips on how to make your business successful in the UAE.

How to Get started in the Insurance Sector in the UAE.

To start an insurance company in the UAE, you will need to meet all of the conditions set out by the Government. Once you have met all of the requirements, you will need to submit original legal documentation to prove your incorporation and compliance with terms and conditions.

How to Start an Insurance Company in the UAE.

The requirements for starting an insurance company in the UAE vary depending on whether you are a corporate or individual business. However, generally, you will need to meet certain conditions before starting an insurance company in the UAE:

-

- Business Plan

- Trade Name Reservation

- Legal Form

- Initial Approval

- Local Service Agent Agreement

- Court Agreement

- Documentation

- Trade License

Business Plan

It has to be explicitly evident what your business goals are and how you will attain them. Though insurance business in UAE is highly profitable, it will be hopeless to fulfill it without an appropriate plan. You ought to have a distinct conception, comprehend probable trade hazards, distinguish risks and hindrances, and elucidate how you are engaging in funding your venture.

Trade Name Reservation

The company’s identity is represented by its name, however, by the United Arab Emirates’ stringent regulations, one must choose their business name very carefully. The chosen name of the business should not be affiliated with any religious form and also should not be an offensive term. Furthermore, neither the owner’s name nor initials can be added to the official title. Ultimately, only after consent from the Department of Economic Development may it be approved and given availability.

Legal Form

You must determine what kind of legal framework you aims to build for your business. In the United Arab Emirates, you can form a business in:

-

-

- Sole proprietorship

- Partnership

- Limited liability company (LLC)

- Free zone

- offshore

-

Initial Approval

After being granted the go-ahead for the business or trade name, the next step is to earn consent from the DED. Total submission of documentation is essential to be looked over and given approval by the DED. Once sanctioned, you have to start on the Local Service Agreement (LSA).

Local Service Agent Agreement

Following the DED review and acceptance, a LSA Agreement must be compiled. This contract can be composed in English or Arabic. Additionally, a notary public is necessary in order to authenticate the document.

Court Agreement

To get the company’s MOA finalized, each stakeholder – consisting of partners and local partners – must go to court to have it notarized. This will require four copies of the arrangement, one for the court, one for the partner, one for the local partner and one for the service provider.

Documentation

Upon DED’s approval of the submitted paperwork, a payment voucher will be issued which serves to certify the business’s entrance into the commercial registry. This payment voucher from DED is regarded as the organization’s trade license.

Trade License

In order to acquire the official trade license, the stated sum in the payment voucher must be given.

Documents required to start an Insurance Company in UAE

-

- Application form

- Trade License copy

- Commercial registry

- Details of the partners

- LLC agreement

- Passport & Visa copy of Authorized Signatory

- DED issued payment voucher of trade license.

Get started with your Insurance Business.

Once you have obtained a license and initialized your business, it’s time to get started on building your customer base and developing your marketing strategy. To do this, you’ll need to start selling your insurance products and services to potential customers. You can do this through advertising, website design, or even face-to-face interactions with potential clients. Additionally, be sure to develop relationships with key partners in the insurance industry who can provide valuable insights into potential customers’ needs and wants.

One of the most important things you need to do when starting an insurance company is learn about the different types of services that are offered by insurers in the UAE. This will help you understand which products and services would be best suited for your particular business model and market niche. In addition, getting involved in industry events organized by Eira or other organizations will give you a better understanding of what kind of feedback and input is necessary for perfecting your product or service. By learning about different types of insurance companies in the UAE, you’ll be well on your way to becoming an established player in this rapidly growing industry.

What are the Benefits of Starting an Insurance Company in the UAE.

The benefits of starting an insurance company in the UAE are many. First, you can get a competitive rate for your business. This will ensure that you have the best possible chance at success and earning a good profit. Additionally, by increasing your revenue, you can save on your insurance costs. This will help you to reach your financial goals faster and maintain a healthy business. Finally, consider saving up for a rainy day – this could be the biggest money maker for your company! Starting in 2025, the UAE will require citizens to have job loss insurance. As a result, a significant number of individuals as well as corporations will purchase this insurance.

Conclusion

Starting an insurance company in the UAE can be a great way to achieve increased revenue and save on your insurance costs. By getting involved in marketing and sales, you can increase your customer base and drive down your rates. Additionally, the benefits of starting an insurance company include competitive rates and easy access to insurance coverage. If you’re interested in starting an insurance business in the UAE, please contact us for more information. Thank you for reading!

In the event that you are interested in receiving expert advice, please do not be reluctant to call our Business Consultant. If you have any questions, please do not hesitate to get in touch with us by e-mail at info@crosslink.ae or by phone at +971 4 321 6631.

Crosslink International brings your corporate dreams to life by providing commendable and timely consultations regarding low-cost business setup in UAE, business set-ups, new business setup in dubai, visa solutions, and professional services that are designed to anchor your business in the United Arab Emirates. Our core principles of openness, efficiency, and secrecy have been critical in supporting hundreds of our most esteemed clients in learning the essence of the United Arab Emirates and, in the process, saving them a great amount of time, effort, and money.

We Guarantee

Because of the criteria for obtaining licenses, starting a business can be a challenging, frustrating, and drawn-out procedure. We exert a lot of effort in order to acquire the essential trading license since we care about our clients and want to keep them as stress-free as possible.

Customers of Crosslink Business Setup Group are assured of success in obtaining visas through the assistance of the company.

During consultations, the Crosslink Business Setup Group offers its valued clients help that is not only cost-free, but also impartial.

No Worries, No Stress: We completely believe in the necessity of total openness about pricing, deadlines, and the criteria for recording, and we place a major emphasis on achieving that goal.

Our Clientele

Our organization, Crosslink International, takes a great deal of satisfaction in the fact that many of our clients are regarded as being among the most well-known in the UAE and elsewhere in the world. Our primary objective is to build enduring relationships with each and every one of our customers while also delivering the highest possible level of service to each and every one of them.